Financial accounting is directed to the people outside the business. The main users of financial accounting are lenders and investors – people who provide the capital to a business.

The lenders want the loan to be repaid. They are interested in:

– Current income

– Existing obligations

– Existing assets

The investors are potential business partners, who will own their part of the company. They want to know:

– If the business is profitable now

– What is the potential for the future

Other External Users of Financial Accounting Data

– Suppliers: can you pay?

– Customers: will you be around in the future?

– Employees: are you able to pay, and will you be around for the long term?

– Competitors: what are your strengths and weaknesses?

– Government: regulation, compliance

– Press: background, investigation

The Three Primary Financial Statements

– The Balance Sheet

– The Income Statement

– The Statement of Cash Flows

The Balance Sheet

The Balance Sheet is built around the accounting equation:

Assets = Liabilities + Equity

Liabilities and Equity are the Sources of Financing.

– Liabilities: borrowed money.

– Equity: money invested by owners.

The Assets are resources, either owned or controlled by a company that will likely provide future benefit.

The Liabilities are obligations that may require sacrifice of future economic benefit in the form of transferring assets or providing services.

The Owners’ Equity is the amount the owners originally invested in the business plus how much profit they have left in the business; ownership interest in the company’s assets.

– Paid-in Capital

– Retained Earnings: profits made by the business and kept in business.

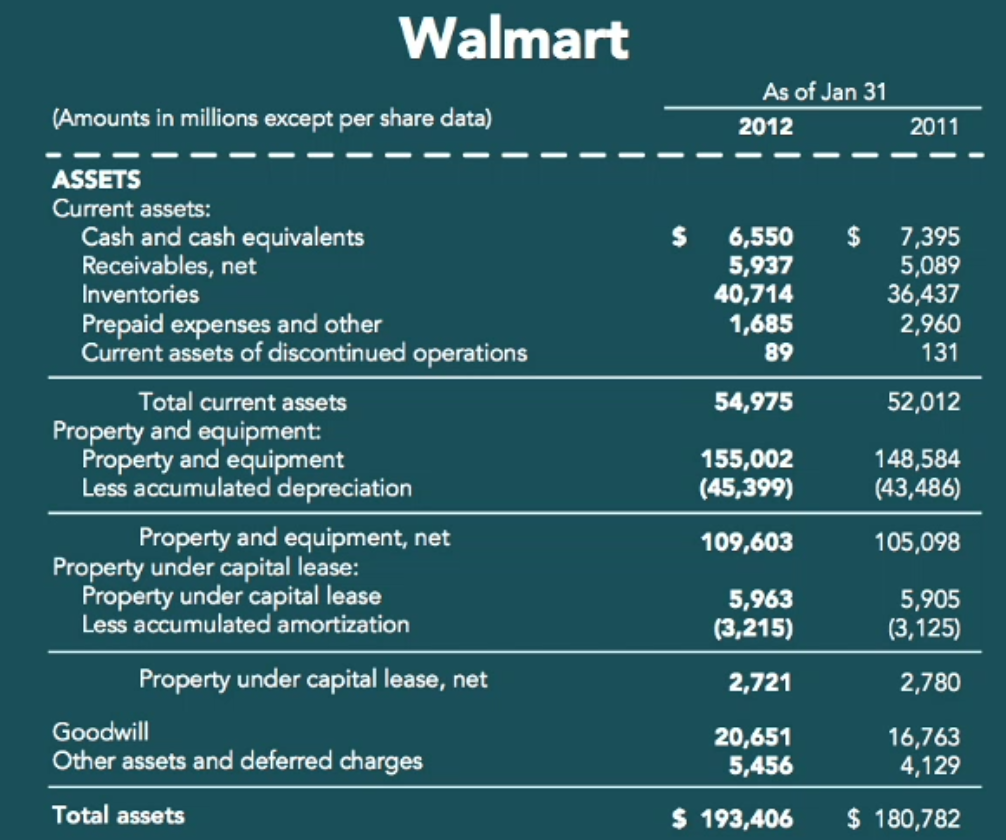

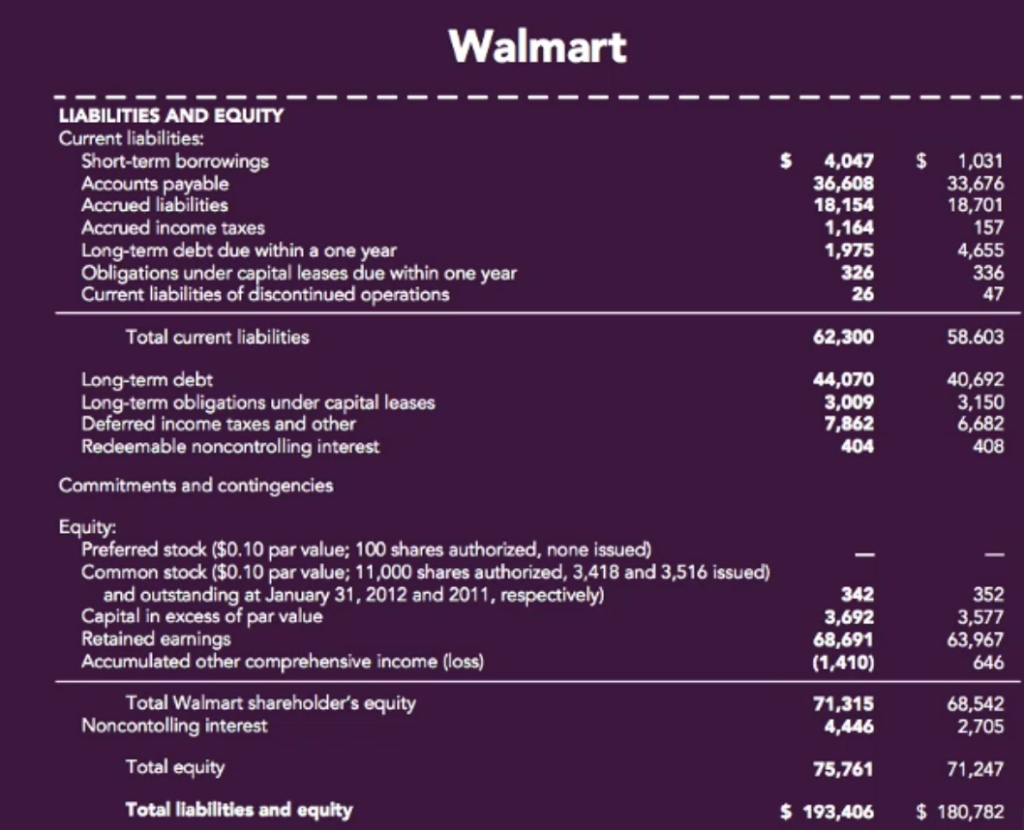

Balance Sheet Example

Short-term borrowings: repaid within one year.

Accounts payable: amount owed on inventory, that Walmart already received but hasn’t paid for yet.

Long-term debt: repayment takes over a year.

Retained Earnings: profits kept in the business and used to buy assets.

Limitations of Balance Sheet

1) Most of the numbers are not market values, they are costs.

Example:

Company bought a land 50 years ago for amount of $5,000.

Now, this land is worth $2 millions.

The amount reported on the balance sheet is the original cost of $5,000.

2) Some economic assets are not reported at all, especially intangible assets.

Example:

Name, Logo, and Loyal customers are intangible assets, which may worth tens of billions of dollars for companies like: Apple, Coca-Cola, Microsoft.

The combination of these two things means that:

Book value of a company NOT EQUAL Market Value of a company

Balance Sheet vs Income Statement

A balance sheet is a snapshot as of right now(pint in time) of what you have and what you owe.

An income statement is about how much did you make in a period of time.

Large US companies report an income statement every 3 months (quarter) and every year, at the end of the year, for entire year.

The Income Statement

Contains two items: Revenues and Expenses.

Revenues – Expenses = Net Income

Revenues: amount of assets created from the sale of goods or services.

Example: Microsoft generates revenues by selling software and hardware.

Expenses: amount of assets consumed in generating revenues. Also caused when liabilities are created in generating revenues.

Example: Business must pay employees, buy equipment, pay bills.

Net Income: overall measure of a company’s economic performance during a period. Also, the difference between revenues and expenses for the period.

Earnings Per Share (EPS):

Net Income DIVIDED BY Outstanding Number of Shares of Stock

Example:

Net Income = $16.978 billion DIVIDED BY Shares Outstanding = $8.405 billion EQUALS EPS = $2.02

This means, if you own one share of stock, the net income declared during a period of time, which is $2.02 belongs to you.

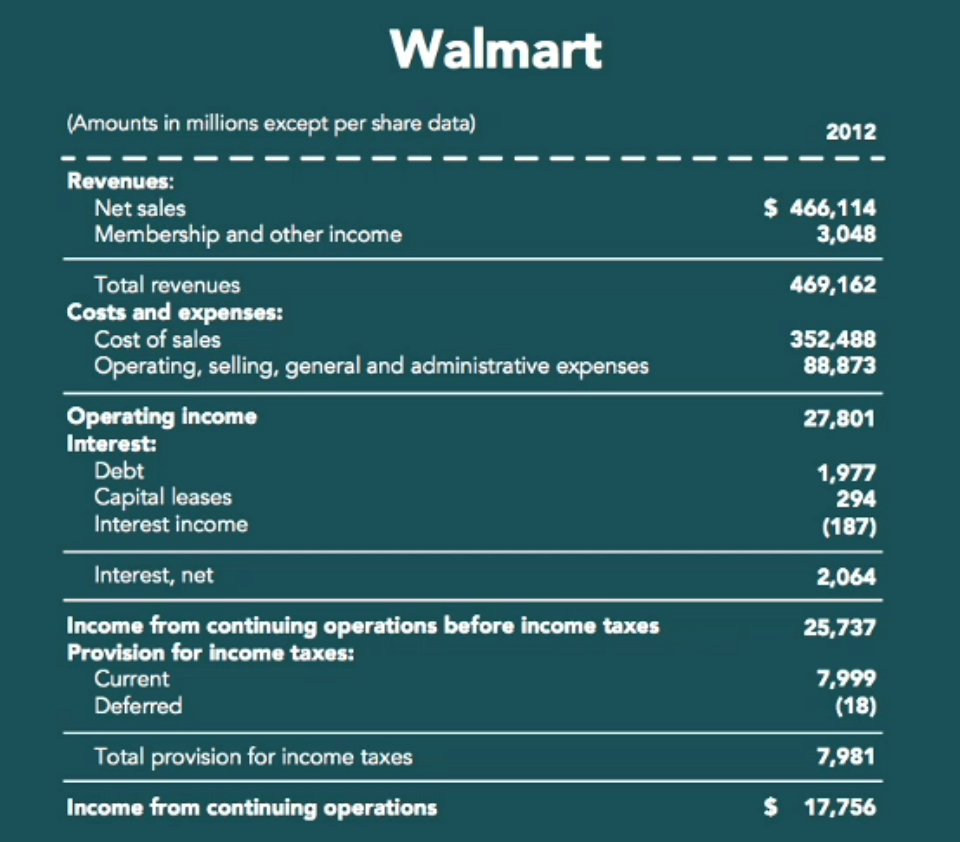

Income Statement Example

Here is an income statement of Walmart, for 12 months period, covering 2012.

Vocabulary:

– Top Line: Sales (Net sales line)

– Bottom Line: Net income (Income from continuing operations line)

Net Income: measures economic performance of a company.

Practical Example

If we buy something at Walmart for 100$, will they keep that whole sum of 100$?

In fact, no.

– They will first pay their suppliers (Cost of Sales).

– Then they will pay employees, utilities, property taxes, advertising (Operating, selling, general and administrative expenses).

– Then they will pay interest on loans (Interest, net).

– Finally, come the income taxes (Total provision for income taxes).

And they are left with the Bottom Line.

How much did it cost Walmart to sell something for 100$?

Let’s return to Income Statement.

Cost of Sales DIVIDED BY Net Sales = 352.488 / 466.114 * 100 = 76%

It will cost Walmart 76$ (76% of 100$).

How much profit will Walmart make from 100$ of sales?

Income from Continued Operation DIVIDED BY Net Sales = 17.756 / 466.114 * 100 = 4%

To conclude, from 100$ of sales, Walmart pays 76$ to suppliers, then after paying expenses, interest and taxes, they are left with 4$ of profit.

How do Walmart stay in business?

Because they sell a lot, which is called Turnover.

Statement of Cash Flows

Cash Flows consists of how much cash did you collect and how much cash did you pay.

There are two types of cash flow:

– Inflows: Receipts

– Outflows: Payments

These flows of cash are separated into 3 categories:

– Operating activities: Selling goods, Providing services, Paying wages, Paying utilities

– Investing activities: Buy buildings, Buy land, Sell buildings, Sell land

– Financing activities: Borrowing money, Receiving investments, Repaying loans, Distributions to owners (dividends)

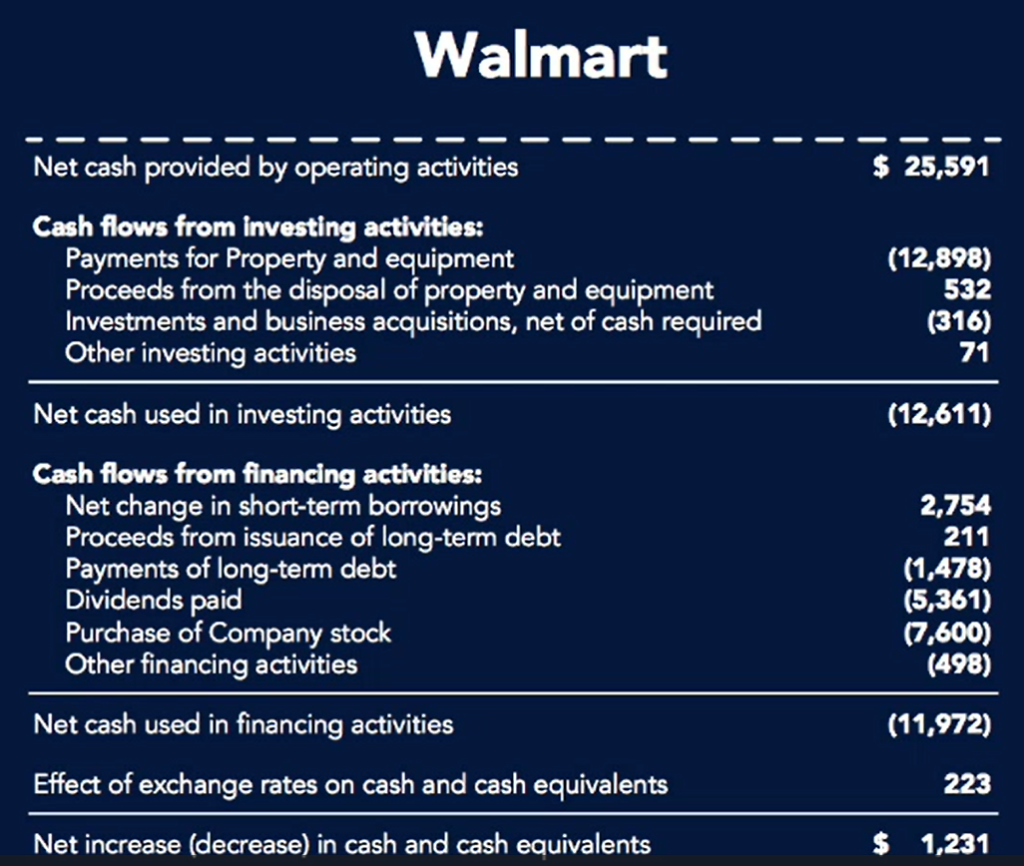

Cash Flow Statement Example

Note:

Net cash provide by operating activities is the most important number in the Cash Flow Statement.

If this number is negative, that may be a bad sign.

From the example above:

Cash Generated (Net cash provided by operating activities) MINUS Cash Invested (Net cash used in investing activities) = $13 Billion Surplus.

Walmart is a Cash Cow. They generate so much cash from their day to day operating activities, so they can pay all they need in cash and still have cash in the budget left over.

Financial Accounting Summary

Focuses on communicating to the people outside of the company, primarily: lenders and investor, who are providing money to the company to buy the assets.

The reports consist of three documents:

– The Balance Sheet: Assets = Liabilities + Equity

– The Income Statement: Revenues – Expenses = Net Income

– The Statement of Cash Flows: Company’s performance = Operating activities + Investing activities + Financing activities

Go back to Introduction to Accounting

Next, learn about Managerial Accounting.