Income Taxes

To better understand the Income Taxes Accounting, lets consider a simple example of a Tax System, implemented somewhere in the world.

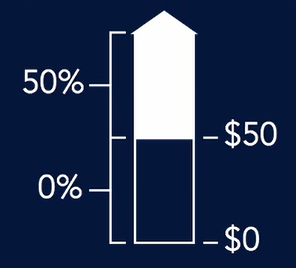

This image represents the percentage of taxes, you have to pay if you’re making a certain amount of revenue.

- From $0 to $50, it’s 0%.

- From $50 and up, it’s 50%.

How much income tax would you pay if you made $50? It’s $0.

And $51? Is it $51 X 50% = $25.5? No. It is $0 for the first $50, then 50% for any additional dollar on top.

So it would be: $0 + $1 X 50% = $0.50

And $100? Same thing. You pay $0 for the first $50. Then 50% for the rest.

So, it would be: $0 + $50 X 50% = $25

Basic cost of living

This factor is taken into consideration, to decide what basic amount of income should be tax free.

Average Tax Rate

It is the percentage of taxes that you pay on the amount of money that you make.

In this system, it would be: $25/$100 = 25%

Marginal Tax Rate

It’s the percentage of taxes that you’re going to pay on the next dollar that you make.

In this system, it would be 50%.

This is the number to consider in case you decide to make some extra money.

Progressive Tax System

The more money you make, the higher average tax rate will be. This is the most common income tax system worldwide.

Regressive Tax

The most common example is Sales Tax – tax applied when you buy goods and services. In this case, the less money you make, the more percent of your income you’re going to pay as sales tax.

Tax Deductions and Credits

If you’re spending your money in a way that the government favours, you could have a Tax Deduction.

This activity could be:

- charitable contribution

- paying mortgage interest on your home

- legitimate business expenses

Example:

You’ve made $100. And you gave $10 to charity.

Now, your taxable income is: $100 – $10 = $90

According to our tax system above:

Your first $50 is tax free

Your second $40 is $40 X 50% = $20 tax

So, in total you will pay $20 in taxes.

Without this tax deduction, it will be: $50 X 50% = $25 in taxes

If you’re spending your money in a very favourable way that the government really wants to encourage, per example, putting solar panels on your roof, to reduce energy consumption, you could have a Tax Credit.

Example:

You’ve made $100. And you bought solar panels for $10 to reduce energy consumption in your home.

According to our tax system above:

Your first $50 is tax free

Your second $50 is $50 X 50% = $25 tax

But, the government gives you $10 in tax credit.

Now the total amount of taxes to pay would be: $25 – $10 = $15

***

In conclusion, what is better: Tax Deduction or Tax Credit?

The choice is obvious here. So the next time you’ll have to choose between Tax Deduction and Tax Credit, opt for Tax Credit.

Capital Gains VS Ordinary Income

Ordinary income is:

Regular wages, salary, interest, dividends, etc.

Capital gains income is:

Income from buying an investment low and selling it high.

As general rule, the Capital gains income is taxed at a lower price.

***

Lets return to our example of simple tax system.

From $0 to $50, the income tax rate is 50%, for ordinary income.

It is 20% for capital gains income.

How much income tax would you pay if you made $100?

If it is ordinary income, this would be $50 X 50% = $25

If this $100 came from capital gains, it would be: $50 X 20% = $10

As we can see, it is much more valuable to have capital gains income instead of ordinary one.

That’s why they are Tax Shelters.

Smart people and businesses structure affairs so income can be classified as capital gains income.

Summary of Income Taxes

Tax brackets

- Income is taxed in chunks.

- The first part is tax free, because it makes part of basic cost of living.

- The rest is divided in parts, so the more money you make, the more taxes you pay.

Average and Marginal tax rates

- Average: the amount of taxes you pay divided by the amount of money you make.

- Marginal: the rate you’re going to pay on the next dollar you make.

Tax deductions and credits

- Tax deduction: $10 given to charity will save you $5 in income taxes.

- Tax credits: $10 spent on government encouraged program will be tax free.

Ordinary income and capital gains

- You pay less taxes on capital gains.

Go back to Managerial Accounting